The impact of account takeover fraud

Secure online identities are crucial for both consumers and businesses. Yet the reliance on passwords, which are integral to online security, pose a significant threat. Weak passwords can be easily compromised, allowing attackers to take control of user accounts and access sensitive information. In this solution brief, we explore the economic impact of account takeover (ATO) fraud, as well as the viability of a passwordless future. We also examine how advanced authentication methods such as biometrics can help organizations increase their security measures to deter fraudsters while improving the user experiences, driving economic growth and stability.

The economic impact of account fraud

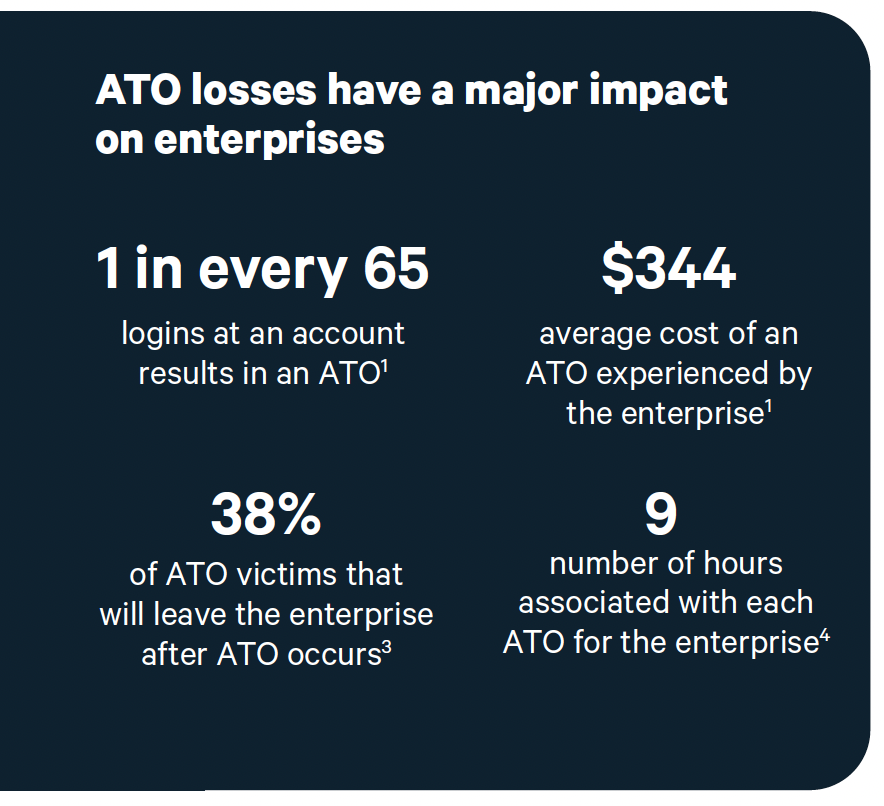

As organizations grow and more businesses move online, Account Takeover (ATO) fraud is on the rise. In 2021 alone, ATO losses increased by 90 percent year-over-year for a staggering total of $11.4 billion in the U.S1. And, with nearly 1 in 3 internet users today2 being victims of an ATO, these types of cyberattacks show no sign of slowing down. Part of the challenge is that ATO attacks can occur on almost any type of online account, with fraudsters using a variety of techniques to gain unauthorized access to user accounts. Passwords exposed in data breaches, as well as cyber threats such as phishing, malware, SIM swapping, and man-in-the-middle attacks, remain popular methods, with new technologies like GenAI increasing the efficiency – and success – of ATO attempts. Your organization can’t afford to lose customers due to account takeover, as the losses extend far beyond the average estimated cost of $344 per attack1. Most consumers hold businesses responsible for protecting their online presence. So, it’s not surprising that more than one third of ATO victims abandon an enterprise after a takeover attempt.

As organizations grow and more businesses move online, Account Takeover (ATO) fraud is on the rise. In 2021 alone, ATO losses increased by 90 percent year-over-year for a staggering total of $11.4 billion in the U.S1. And, with nearly 1 in 3 internet users today2 being victims of an ATO, these types of cyberattacks show no sign of slowing down. Part of the challenge is that ATO attacks can occur on almost any type of online account, with fraudsters using a variety of techniques to gain unauthorized access to user accounts. Passwords exposed in data breaches, as well as cyber threats such as phishing, malware, SIM swapping, and man-in-the-middle attacks, remain popular methods, with new technologies like GenAI increasing the efficiency – and success – of ATO attempts. Your organization can’t afford to lose customers due to account takeover, as the losses extend far beyond the average estimated cost of $344 per attack1. Most consumers hold businesses responsible for protecting their online presence. So, it’s not surprising that more than one third of ATO victims abandon an enterprise after a takeover attempt.

Have questions about ATO prevention? Schedule a discovery session with a fraud specialist today.

Strengthen trust in real-world identities with MiPass biometric authentication

MiPass is a passwordless identity authentication solution that allows a person to access digital accounts securely using two features that are uniquely theirs: voice and face. MiPass helps safeguard your business and your customers by using a sophisticated combination of biometrics that are extremely difficult to falsify. It affirms your customers identities in seconds and provides them with simple, secure access to your services.

MiPass is a passwordless identity authentication solution that allows a person to access digital accounts securely using two features that are uniquely theirs: voice and face. MiPass helps safeguard your business and your customers by using a sophisticated combination of biometrics that are extremely difficult to falsify. It affirms your customers identities in seconds and provides them with simple, secure access to your services.

Easier for customers, harder for fraudsters

MiPass allows customers to enroll their face and voice biometrics to enjoy the convenience and security of using a passive, passwordless biometric for simplified access. As these biometrics are difficult to replicate, they make it harder for fraudsters to takeover an account.

Advanced authentication means fewer ATOs

MiPass offers high-fidelity face and voice biometrics combined with user liveness detection to provide a level of security that passwords simply can’t meet. This enhanced level of security helps increase trust and reduce attrition with customers.

- Trained algorithms tested against balanced data sets ensure accurate authentication regardless of race, ethnicity, age, or gender.

- Customers are quickly authenticated using their face, or voice, or both. Removing passwords from the process also removes one-time passcodes and password resets.

- Biometric templates are mathematical representations of a user’s unique characteristics and so complex that they provide virtually no attack vector for criminals.

Lower operational costs

ATOs can have a significant impact your financial bottom line, as identifying takeover attempts and distinguishing between fraudulent and legitimate user activity consumes valuable time and resources that could be more effectively allocated elsewhere. With MiPass, operational expenses can significantly decrease due to the reduction in resolution hours associated with each attempt.

Secure, frictionless, enterprise grade biometrics

With MiPass, businesses are better equipped to meet strong customer authentication (SCA) standards by adding a more secure authentication factor (something you are) instead of relying on passcodes (something you know) and device-based methods (something you have). Our developer-friendly SDK makes it simple to quickly embed and customize cloud-based biometric enrollment and authentication into a wide variety of trusted identity use cases. By deploying biometric authentication directly within your enterprise application – rather than relying on biometrics built into consumer devices – you gain a far superior layer of protection without compromising convenience for customers.

Key features

- Bias-free authentication

- Reduced friction

- Advanced security

- Device agnostic access

- Scalable performance

The cost of account takeover fraud extends beyond immediate financial losses, affecting customer trust and retention. By adopting robust, passwordless biometric authentication like MiPass, businesses can protect their businesses and customers, and reduce operational costs.

If you'd like to learn more about safeguarding your organization against ATO fraud, please reach out to us today.

SOURCES: 1 Javelin Strategy & Research, 2022 Identity Fraud Study, 2022; 2 Security.org, account takeover annual report 2024; 3 Identity Theft Impacts Nearly Half of U.S. Consumers, Aite Group Report Study, 2020; 4 Miracl, Account Takeover fraud likely exceeded $25 billion