Check fraud is surging—why? According to the Boston Fed, “The answer is opportunity. [Check fraud is] a low-tech and relatively easy crime to pull off, and there is still a sizeable pool of potential victims.” If you’re part of the “sandwich generation”—an adult who is caring both for your own children as well as aging parents or other elderly loved ones—you’ve got yourself and two other risk pools to worry about. I’ve put together a three-part blog series to help you teach teens and elders how to protect themselves from check fraud and, in the process, protect yourself.

Check fraud is surging—why? According to the Boston Fed, “The answer is opportunity. [Check fraud is] a low-tech and relatively easy crime to pull off, and there is still a sizeable pool of potential victims.” If you’re part of the “sandwich generation”—an adult who is caring both for your own children as well as aging parents or other elderly loved ones—you’ve got yourself and two other risk pools to worry about. I’ve put together a three-part blog series to help you teach teens and elders how to protect themselves from check fraud and, in the process, protect yourself.

- Part 1 provides an overview of how check fraud happens in teens’ social media-centric world, and tips on how you can talk with your kids to help them avoid these painful situations.

- Part 2 addresses how parents can protect themselves from check fraud perpetrated against their minor and adult children, and what you can expect as the responsible party if your child unfortunately becomes a victim of check fraud.

- This blog, part 3, explains why the elderly are more susceptible to scams involving paper checks, and offers three tips on how to reduce their chances of becoming a victim.

Why check fraudsters target the elderly

Although check writing is dwindling, about 25% of Americans age 65 and older (that’s 62 million people) report a preference for writing checks, the largest amount of any demographic. Paper checks written by the elderly are highly susceptible to fraudulent because they can be:

- Stolen from residential mailboxes and postal drop boxes

- Used as payments to financial criminals targeting the elderly with everything from romance scams to fake charity scams

- Physically manipulated by a process called check washing, in which payees’ names, check numbers and amounts are altered and the check fraudulently redeposited, often multiple times

- Hijacked by fraudsters who use routing and account numbers from physical checks to create facsimiles of new checks, which are then filled out and deposited.

Check fraud can also be perpetrated by an elder’s own loved ones. Elder financial exploitation is the fastest-growing form of elder abuse, a crime that can be committed by family members, friends, neighbors, caregivers, health care providers and other trusted individuals. Here, blank checks can be more easily stolen, or written checks intercepted and washed.

Bring check fraud out of the shadows

Check fraud crimes against elders are likely under-reported. The U.S. Federal Bureau of Investigation (FBI) 2023 Elder Fraud Report revealed that its Internet Crime Complaint Center received 3,182 complaints filed by elders related to credit card/check fraud, with total associated losses amounting to $37,862,023. This is a very small number compared to 680,000 check fraud reports issued by banks in 2023, amounting to an estimated $24 billion.

It’s likely that check fraud crimes are under-reported due to the fear and shame elders may feel if they are victims. This news story, about a 93-year-old woman in California whose caregiver committed check fraud using stole blank checks, illustrates a range of complex emotions, and the challenge of recovering stolen funds.

Building up awareness and defenses

Caregivers can be in a difficult position when it comes to their parents’ financial matters, torn between providing well-meaning oversight and preserving elders’ independence and dignity. Here are three ways to enlist seniors’ help in avoiding check fraud.

-

Take steps to reduce risk: Explain to your loved ones what check fraud it is, how anyone can become a victim, and the high risk paper checks can pose. You can suggest that the two of you set up mobile banking on the elder’s phone if they don’t have it, and that the two of you will pay bills together from there—paper checks should only be used in specific, secure situations. It’s recommended that, in your role as trusted financial caregiver, you get permission from your parent or loved one to monitor their accounts through web or mobile access.

- Monitor transactions: If you have access to your loved one’s accounts, use the banking app’s text alert features to notify you of any transactions over a certain threshold, such as $50. Log on daily to monitor activity, as well, to become immediately aware of any unusual or unauthorized activity, including suspicious checks drawn against the account. Like all fraud types, reporting check fraud promptly is the best way to mitigate potential losses.

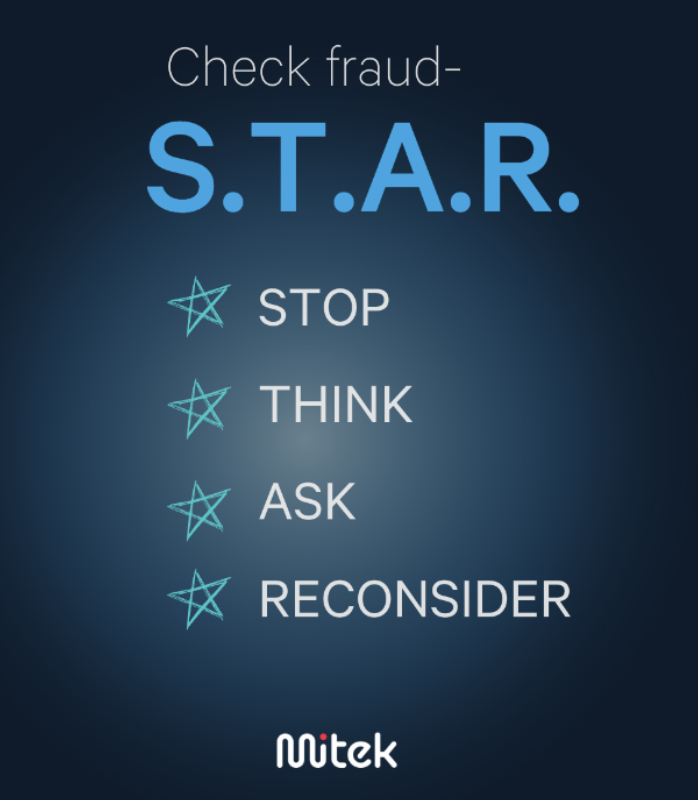

- Encourage your loved one to reach out: If your parent is approached by an acquaintance or stranger and pressured to send a check for any reason—to make a charitable donation, pay a debt, provide emergency funds to a purported relative or friend, or myriad other reasons—work with them to develop a safe “STAR” reflex:

- Stop: Don’t immediately follow through on the request, even if the person seems desperate or is pressuring you. Stop for a moment; fraudsters rely on feelings, not facts, to perpetrate check all scams, including check fraud.

- Think: Remember that all manner of check fraud can start by giving someone a single check, whether blank, endorsed or completely filled out.

- Ask: For any money request, let your loved one know they can (and should) ask for your opinion on its legitimacy. Reinforce that getting this second opinion is simply good financial hygiene and not punitive.

- Reconsider: Given the onslaught of scams and frauds targeted at elders, it’s highly likely that any abrupt request to send a check to an unknown person is fraudulent––no matter how nice they seem, or how badly they say they need you to help them.

Resources to help you stay vigilant

Fraudsters are infinitely creative in devising new scams and schemes to defraud seniors. You can help protect your elderly loved ones with resources including:

- The Identity Theft Resource Center, a non-profit organization established to minimize risk and mitigate the impact of identity compromise and related crimes. The ITRC has excellent newsletters and media alerts with breaking news.

- AARP Fraud Watch Network has useful fraud prevention resources and biweekly Watchdog Alerts with the latest fraud-fighting news (AARP subscription required).

- The National Elder Fraud Hotline (833.372.8311) for reporting elder scams.

- Smart Money for Older Adults, a program developed by the Federal Deposit Insurance Corporation (FDIC) and the Consumer Financial Protection Bureau (CFPB) to raise awareness among older adults and their caregivers on how to prevent fraud, scams and other elder financial exploitation.

Respectful and compassionate communication can go a long way in building your elders’ confidence in sharing their vulnerabilities with you. By keeping channels open and destigmatizing discussions about money and fraud, you and your loved ones can work together to preserve their financial health.

Follow me on LinkedIn to keep up with my latest thoughts on check fraud and how to fight it. You’ll be glad you did.

About Kerry Cantley - VP, Digital Banking Strategy at Mitek

Kerry Cantley is VP of Digital Banking Strategy at Mitek, leading the strategic expansion of Mitek’s Check Fraud Defender service, which detects forgeries and fraudulent activity across all deposit channels, otherwise missed by traditional fraud prevention protocols.