What you can do to minimize the trauma of check fraud if your child is a victim

A few weeks ago I kicked off my blog series for parents about check fraud with a cautionary tale: my friend Kathy was held liable for $4,000 in bad checks deposited by her 18 year old son, a victim of a romance scam. In this blog I’ll talk about what you should do to minimize damage if your child becomes a victim of check fraud, possible outcomes, and ways to proactively shield your kids and your finances.

A few weeks ago I kicked off my blog series for parents about check fraud with a cautionary tale: my friend Kathy was held liable for $4,000 in bad checks deposited by her 18 year old son, a victim of a romance scam. In this blog I’ll talk about what you should do to minimize damage if your child becomes a victim of check fraud, possible outcomes, and ways to proactively shield your kids and your finances.

Actions to take if your child is a victim

If you discover that your teen or otherwise minor child (or adult child whose checking account is still your custodial responsibility) has deposited checks on behalf of a new “friend” or love interest and sent out funds against those deposits, it’s important to act immediately. Here are some steps to follow:

- Talk with your child: Let your child know that they have deposited a check(s) that is likely bad, describing what that means, and why it’s illegal to both write and deposit bad checks. Explain that even though they were a victim of a scam, both of you may be held responsible to pay back the bank for the money that was sent out. Stay calm and stick to the facts; your child will likely feel a variety of emotions upon hearing they were tricked into committing a financial crime with an expensive punishment.

- Call the bank and open a fraud case: It’s important to let your bank know as soon as possible that your child was scammed into depositing the checks, that they did so unknowingly, and that you now believe the items were fraudulent. Your bank will likely refer you to its fraud department, where you can provide the details of the crime. If your teen is able, have them participate in the call.

- Stop the outflow: Make sure that no more bad checks are in the process of being deposited (such as via ATM) into your child’s account. If your child has any additional checks in their possession, which are often sent as email or direct message attachments, have them send the documents to you. This can be useful evidence in a police investigation.

- Make a personal connection at the local branch: Go to your local branch and speak with the manager, explaining the circumstances about the crime that your child committed unknowingly. If possible, ask the manager to help with the fraud investigation—you may need it. (See “Unwelcome surprises” below.)

- File complaints with local police and the FTC: Many people do not report check fraudsters out of shame or mental exhaustion. Go the distance and report the crime to your local police department, as well as to the Federal Trade Commission. Many check fraudsters concentrate their efforts in specific locales and against specific banks. The information you provide may help police crack a crime ring.

Read Part 1 of 'What every parent must know about check fraud'

Unwelcome surprises

Following the steps above can go a long way in helping you and your teen recover from being victimized by a brazen scammer. But as the custodial parent responsible for your child’s account, you may receive some unwelcome surprises such as learning that:

- Being scammed is not the same as being defrauded: Most banks define fraud as a third party gaining access to your account credentials and using them without your knowledge or consent. This is what occurs in credit card fraud, which many people have experienced. If a complaint is filed promptly, victims are generally not held liable for fraudulent card charges.

Your child being scammed by a check fraudster is not, technically, fraud—your child knowingly deposited the checks and sent out funds. As a result, as the custodial relationship on the account, you may be liable for all funds transferred out of your child’s account. The good news is, some banks may not hold a customer liable for the full amount of bad check deposits if the full amount is not transferred out of the account, otherwise spent or can be recovered.

- Provisional credits may be reversed: During a fraud investigation, your bank may issue provisional credits for funds sent out via P2P payment services such as CashApp and ApplePay—which may give you hope. Your bank may ask the P2P service providers to investigate the transfers to determine if they were fraudulent, i.e., made by a party other than your child, the account owner. These services typically trace the IP address from which the payment was made; if the IP address and device belong to the true account owner, no refund will be made by the P2P service provider to the bank. In turn, your bank will likely reverse the provisional credits.

- You may lose digital banking privileges: Accounts under investigation for fraud often have digital banking privileges revoked or suspended during investigation. If you have custodial responsibility for your child’s account, your mobile banking app and web access may be suspended, as well. But don’t panic—go to your local branch and ask for it to be restored. Most banks will work with you and help you with access restoration and remediation, if possible.

- Your account may be frozen or closed: Similarly, accounts being investigated for fraud can be frozen. In the case of a parent with a custodial account, only the child’s account generally will be frozen. If yours is, as well, you can ask a manager at your bank to restore access. However, depending on the bank’s policies, your child’s account can be closed when the fraud investigation is complete. This can help to ensure no additional fraud losses. The most important part of action is quick communication and exchange of information with your financial institution.

Protect your family from fraud

The best way to protect your finances, and your children, from check fraud is to proactively reduce opportunities for harm. Part 1 of this series details the steps that parents can take to mitigate risk; I’ll reprise the most critical ones here:

- Have your child assume responsibility for their account when they become a legal adult: When your child turns 18 you both may receive a letter from the bank, notifying the child that they can assume legal responsibility for their account. Make sure your child takes this important step toward “adulting”—it will build confidence in their financial skills and eliminate your potential liability, both from providing overdraft protection and from having legal responsibility for illicit deposits.

Should an adult child fall victim to check fraud, most parents will want to do everything in their power to help, but their first priority is to protect the familial financial enterprise. Doing so requires removing custodial liability. If your adult child’s account remains under yours, associated responsibilities and liabilities will persist. Another good approach is to talk to your financial institution or relationship manager about how to best accomplish account set up and access to fit your family’s needs.

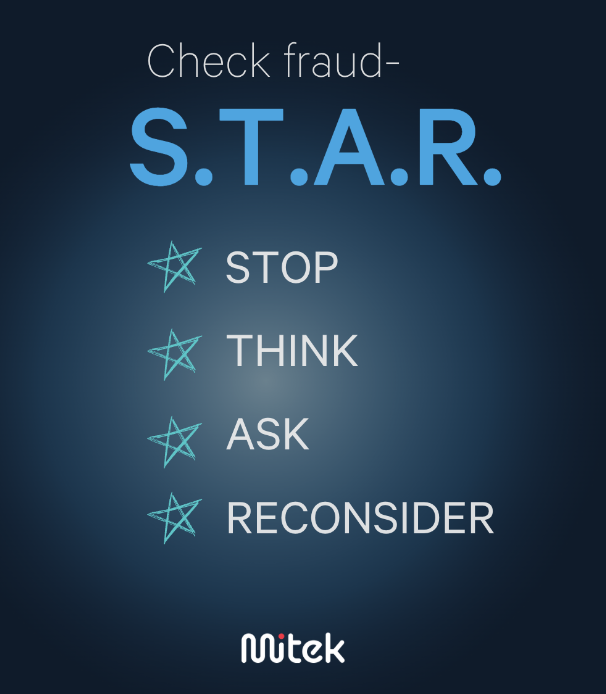

Teach your teen to be a STAR: If your child is asked to deposit a check, work with them to develop a safe “STAR” reflex:

Teach your teen to be a STAR: If your child is asked to deposit a check, work with them to develop a safe “STAR” reflex:

- Stop: Don’t immediately follow through on the request to deposit the check—even if the person seems desperate or is pressuring you. Stop for a moment; fraudsters rely on feelings, not facts, to perpetrate check all scams, including check fraud.

- Think: Remember that when your deposit a check, you personally assume responsibility that it is genuine and backed by legitimate funds. If you’re unsure, don’t do it.

- Ask: Who is the person asking you to deposit a check? Do you know them in real life (IRL)? Is the person a stranger? Do your friends know who this person is? Do a quick online search to further check them out. If no one knows them IRL, and they don’t have a digital footprint, the stranger is not who they say they are.

- Reconsider: In life, many things that seem too good to be true often are. A stranger offering you hundreds or thousands of dollars for free, in exchange for a simple deposit and money transfer, is always too good to be true—no matter how nice they seem, or how badly they say they need you to help them, or how attractive the offer.

Working with your child, you can minimize the risk of check fraud—and the psychological and financial trauma if its misfortune strikes. Together, you will get through this!

Next I’ll publish the third and final installment of this blog, for readers who care for their parents or other elders. While most check fraud targeting teens occurs digitally, the elderly are more susceptible to scams involving paper checks. I’ll provide an overview of common scams, signs of financial elder abuse, and how caregivers can work together with their loved ones to combat check fraud.

Follow me on LinkedIn to keep up with my latest thoughts on check fraud and how to fight it. You’ll be glad you did.

About Kerry Cantley - VP, Digital Banking Strategy at Mitek

Kerry Cantley is VP of Digital Banking Strategy at Mitek, leading the strategic expansion of Mitek’s Check Fraud Defender service, which detects forgeries and fraudulent activity across all deposit channels, otherwise missed by traditional fraud prevention protocols.