42 check fraud statistics your bank can't ignore

A comprehensive list of helpful check fraud stats

According to the 2024 Abrigo Fraud Survey, 61% of Americans still write checks. An ABA Banking Journal article reports that checks are the second-most-common form of payments for values exceeding $500. Despite a decline in overall check volume, incidents of fraud and the resulting losses remain high.

The significant increase in check fraud and associated losses has prompted urgent action from the U.S. government, banks, fintech companies, and credit unions to bolster their defenses.

Stats on the rise in check fraud

1. The 2024 AFP® Payments Fraud and Control Survey Report cites checks as the payment method most vulnerable to fraud, with 65% of organizations reporting check fraud activity.

2. An AARP article on check fraud reports that 90% of all forged checks are drawn on bank accounts that are less than one year old.

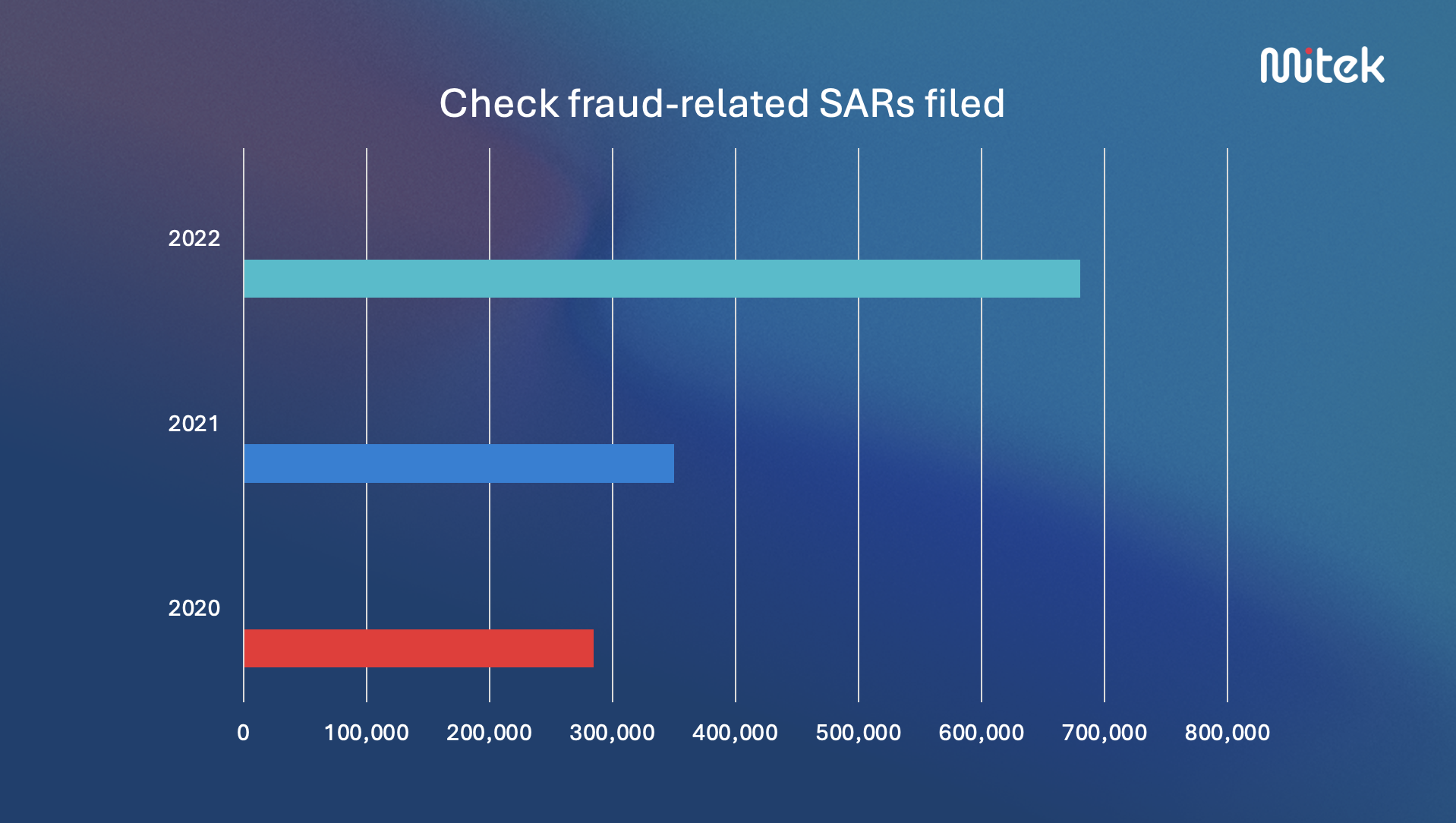

3. According to the Financial Crimes Enforcement Network (FinCEN), financial institutions filed over 350,000 Suspicious Activity Reports (SARs) on check fraud in 2021. FinCEN also reported that in 2022, the number of SARs related to check fraud hit an all time high, exceeding 680,000.

4. As per The Thomson Reuters Institute's 2023 Suspicious Activity Report, there were 285,000 check fraud-related SARs filed in 2020.

5. CNN reported that check fraud increased nationwide by 385% since the pandemic, according to the U.S. Treasury Department.

Criminal tactics

Check fraud's lowest barrier for entry: the mail

6. The 2024 AFP® Payments Fraud and Control Survey Report also reports that fraud due to interference with the United States Postal Service (USPS) is up 10 percentage points over the past year, with 20% of respondents reporting this type of fraud.

7. Postal services robberies only occurred 80 times in 2018, but now are almost a daily event.

8. Letter carriers were robbed 717 times in fiscal 2022 and the first half of fiscal 2023, according to the USPS Postal Inspection Service.

9. According to a CBS news report, mail theft skyrocketed, from fewer than 60,000 complaints in 2018 to more than 250,000 in 2023.

10. A U.S. Postal Service letter carrier in Washington, D.C. allegedly stole checks worth a total of almost $1.7 million.

11. According to the United States Postal Service (USPS), they delivered over 116 billion pieces of U.S. Mail to over 166 million residential and business addresses across the United States in 2023.

12. In a recent FinCEN Alert on Nationwide Surge in Mail Theft-Related Check Fraud Schemes, it was reported that from March 2020 through February 2021, the USPIS received 299,020 mail theft complaints, which was an increase of 161 percent compared with the same period a year earlier.

13. The same FinCEN alert states that BSA reporting for check fraud has also increased in the past three years, nearly doubling YoY, with check criminals committing mail theft-related check fraud generally targeting the U.S. Mail. They aim to steal personal checks, business checks, tax refund checks, and checks related to government assistance programs, such as Social Security payments and unemployment benefits. Business checks are cited as the most valuable to criminals because they are often well-funded and it may take longer for the victims to notice the fraud.

14. According to a 2024 Scripps News report, more than 8,000 arrow keys have been stolen or gone missing since 2018. Arrow keys are master USPS keys that unlock secure blue collection boxes, cluster box units, and apartment mailbox panels.

15. One victim mailed a check for $656 to pay off her AmEx balance only to learn that it was cashed by a complete stranger for $9,000.

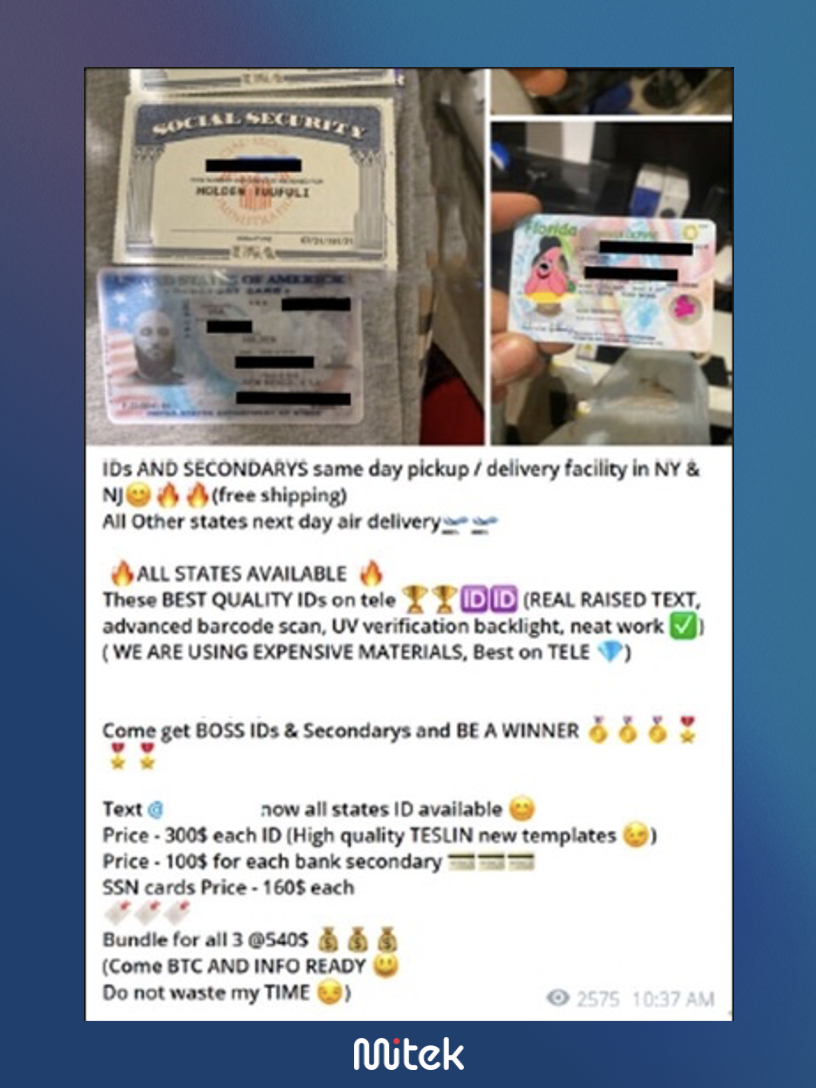

Check fraud on the dark web and social media

16. Georgia State University’s Evidence-Based Cybersecurity Research Group found that an average of 1,325 stolen checks were being sold online in the dark web groups they observed in 2021.

17. A Scripps News investigative team discovered hundreds of personal, handwritten checks from across the country, likely stolen from mailboxes, being openly sold on Telegram.

18. According to the Federal Trade Commission, social media has also been infiltrated by check fraud, contributing to more than 95,000 people reporting about $770 million in losses to fraud initiated on social media platforms in 2021.

19. In a recent blog post, Frank McKenna discusses how an LA fraud gang recruited people on social media to deposit hundreds of thousands of dollars in stolen checks to bank accounts and then quickly withdrawing funds and making purchases before the fraud could be detected.

The cost of check fraud

Check fraud loss statistics are alarming.

20. In 2023, financial institutions experienced unprecedented financial losses due to a surge in check fraud, with one institution alone reporting $135 million in losses.

21. The total check fraud losses in the Americas in 2023 reached nearly $21 billion, according to Nasdaq's Global Financial Crime Report.

22. That same $21B in check fraud losses represents 80% of check fraud losses worldwide.

And...

23. Even though the FBI says that 70% of U.S. financial institutions have reported check fraud, which has resulted in over $18 billion in losses...

24. A 2024 survey from The Association for Financial Professionals reports that despite the high rate at which checks are a frequent target of payments fraud, 70% of organizations currently using checks do not plan to discontinue their use of checks within the next two years.

Check fraud is not slowing down in the US.

25. According to the Mitek 2023 Mobile Deposit Benchmark Report, nearly one-third of all small businesses in the U.S. were victims of check fraud in 2023. Of those, 65% reported losses exceeding $50,000 - a significant sum of money for a small business to absorb, especially in uncertain times. In the same survey, 47% of small business respondents reported that check fraud and fake checks are a "big concern.”

26. The 2023 Federal Reserve Financial Services Financial Institution Risk Officer Survey found that the largest year-over-year increase in financial institution losses was in checks (12% increase), followed by credit card (8% increase). https://www.frbservices.org/binaries/content/assets/crsocms/news/research/2023-risk-officer-survey.pdf

27. According to the Better Business Bureau (BBB), the average fake check or money order scam resulted in $1,500 in losses per item for financial institutions.

28. In a recent article written for the Jackson Sun, the Better Business Bureau’s Mid-South CEO and president, Randy Hutchinson, claimed that check washing accounts for over $815 million in losses to individuals, businesses, and financial institutions per year.

29. Per an article in BankDirector, check fraud and fake checks cost banks approximately $6 per check processed in 2022, according to a recent estimate from SouthState Bank’s correspondent division.

The impact of check fraud on consumers

In April 2024, Abrigo published their 2024 Fraud Survey, which polled more than one thousand adults in the U.S., across multiple demographics. Some of their findings are alarming, and in some cases, very unexpected.

30. Check fraud losses are projected to soar past 24 billion dollars in 2024

31. About 45% of respondents reported being a victim of financial fraud,

32. and 17% of that group report experiencing check fraud in particular.

33. Almost a third of those surveyed admitted to either not following best practices to avoid check fraud or being unsure whether they do so.

34. 51% of check fraud victims had been targeted two or more times.

35. 31% of check fraud victims were unable to recoup all their losses

36. Surprisingly, 61% of Americans are still writing checks, and unexpectedly, Gen Z and Millennials self-reported writing more checks than Gen Xers 45 – 54 years old:

- 59%, age 18 – 24 years

- 57%, age 25 – 34 years

- 60%, age 35 – 44 years

- 48%, age 45 – 54 years

- 61%, age 55 – 64 years

- 77%, age 65+ years

The check fraud net is cast far and wide.

37. The BBB’s Fake Check Scams study found that fraud impacts victims of all ages and income levels.

38. Interestingly, the Federal Trade Commission’s Consumer Sentinel complaint database shows that victims between 20 and 29 years old account for the largest percent of complaints at 21%.

39. According to the Nasdaq Global Financial Crime Report, consumer scams across various regions resulted in estimated losses of $43.6 billion, significantly impacting everyday individuals and businesses with potentially life-changing consequences.

What the data is telling us about fighting check fraud

Check fraud isn't going anywhere anytime soon. In fact, it is escalating and evolving at an alarming rate. Consumers are looking to the businesses they trust to lead them through the check fraud quagmire and keep them safe at every step.

This 2024 Abrigo infographic frames up where consumers sit when it comes to check fraud:

40. 70% of consumers trust banks to do what’s right. For fraud (including check fraud), this means protecting their assets and data.

41. 70% of fraud victims feel anxious, stressed, displeased, or frustrated when warned about new potential fraud, like check fraud.

42. 72% of consumers believe companies should sacrifice the bottom line to better serve them and protect their bank accounts.

Combatting check fraud is not an easy task and requires a layered, thorough, and deliberate strategy to succeed. A rapid and proactive response to counter evolving check fraud tactics must ring paramount with all organizations that deal with checks today, including establishing these 3 pillars within your programs and procedures:

- Provide awareness & education to both consumers and businesses.

- Implement a sophisticated and modern technological solution.

- Commit to collaboration and legislation that will strengthen legal frameworks and regulations related to check fraud.

Minimizing check fraud and safeguarding financial transactions has to be an ongoing commitment, but you can stay ahead of the game if you address it head-on with a comprehensive approach that accounts for financial impact, resource allocation, and implications for client value, reputation, and regulatory compliance. Hopefully these check fraud statistics will also help in your fight against fake checks.

Learn more about check fraud and check fraud solutions

Conor Rector is a content and customer advocacy leader focused on helping people understand identity, fraud prevention, and the technology shaping how we protect what’s real. With a background spanning storytelling, brand strategy, and community building, Conor brings a thoughtful, human-centered approach to complex topics.

https://www.linkedin.com/in/conor-rector-2178188/ Senior Content Lead at Mitek